Social & Financial Decision-Making

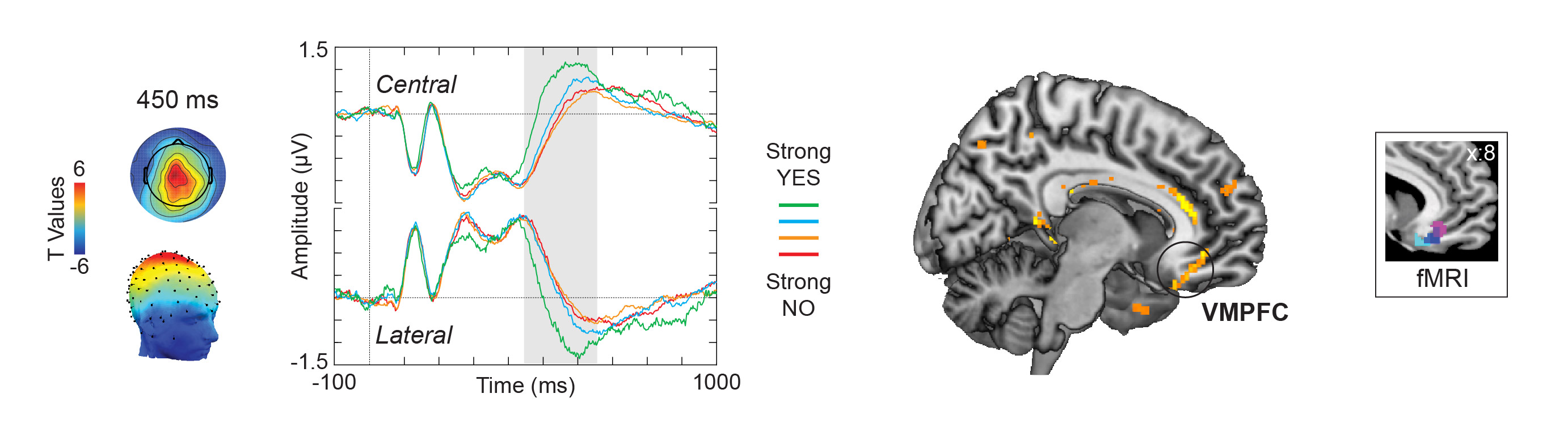

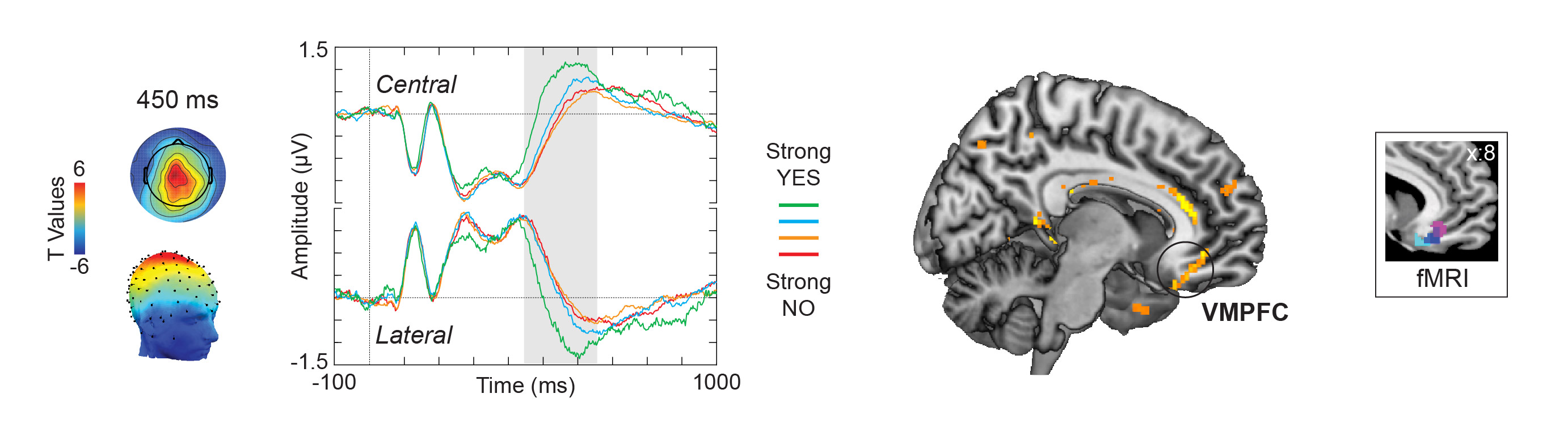

Decision making is often more complicated than simply picking what we like for ourselves, whether we’re making lunch for our children or making medical or legal decisions as proxies for others. How do we choose for others, particularly when their preferences differ from our own? Combining ERP with computational modeling, we found that integration of others’ preferences occurs over the same timescale as for oneself, while differentially tracking recipient-relevant attributes (Harris, Clithero & Hutcherson, in preparation). Financial trading presents another complex decision scenario where investors must take into account both the current valuation of a stock and whether it is gaining or losing value. In a joint project with Drs. Cary Frydman and Tom Chang at the USC Marshall School of Business, we have collected brain activity while people made investments in an experimental stock market. Preliminary results suggest that the VMPFC integrates the value of capital gains on a similar timescale as other goods like food, and this activity is correlated with the propensity to sell winning stocks too soon (the “disposition effect”).